Welcome to our comprehensive guide on payday loans! In this article, we’ll dive deep into the world of payday loans, shedding light on how they work, their benefits and drawbacks, interest rates, eligibility criteria, application processes, and much more. Whether you’re considering a payday loan or simply curious about them, this guide will provide you with valuable insights.

Payday Loans, often referred to as cash advances or paycheck advances, are short-term loans designed to provide immediate financial relief. These loans are typically repaid on your next payday, hence the name. They are unsecured loans, which means you don’t need to provide collateral. Payday Loans offer a practical solution for those who find themselves in a temporary financial bind and need funds to cover essential expenses.

What is a Payday Loan?

A payday loan is a short-term, unsecured loan that is typically designed to help individuals bridge the gap between paychecks. It’s a small-dollar loan that can be a lifesaver in emergencies. People often turn to payday loans to cover unexpected expenses like medical bills, car repairs, or other urgent needs.

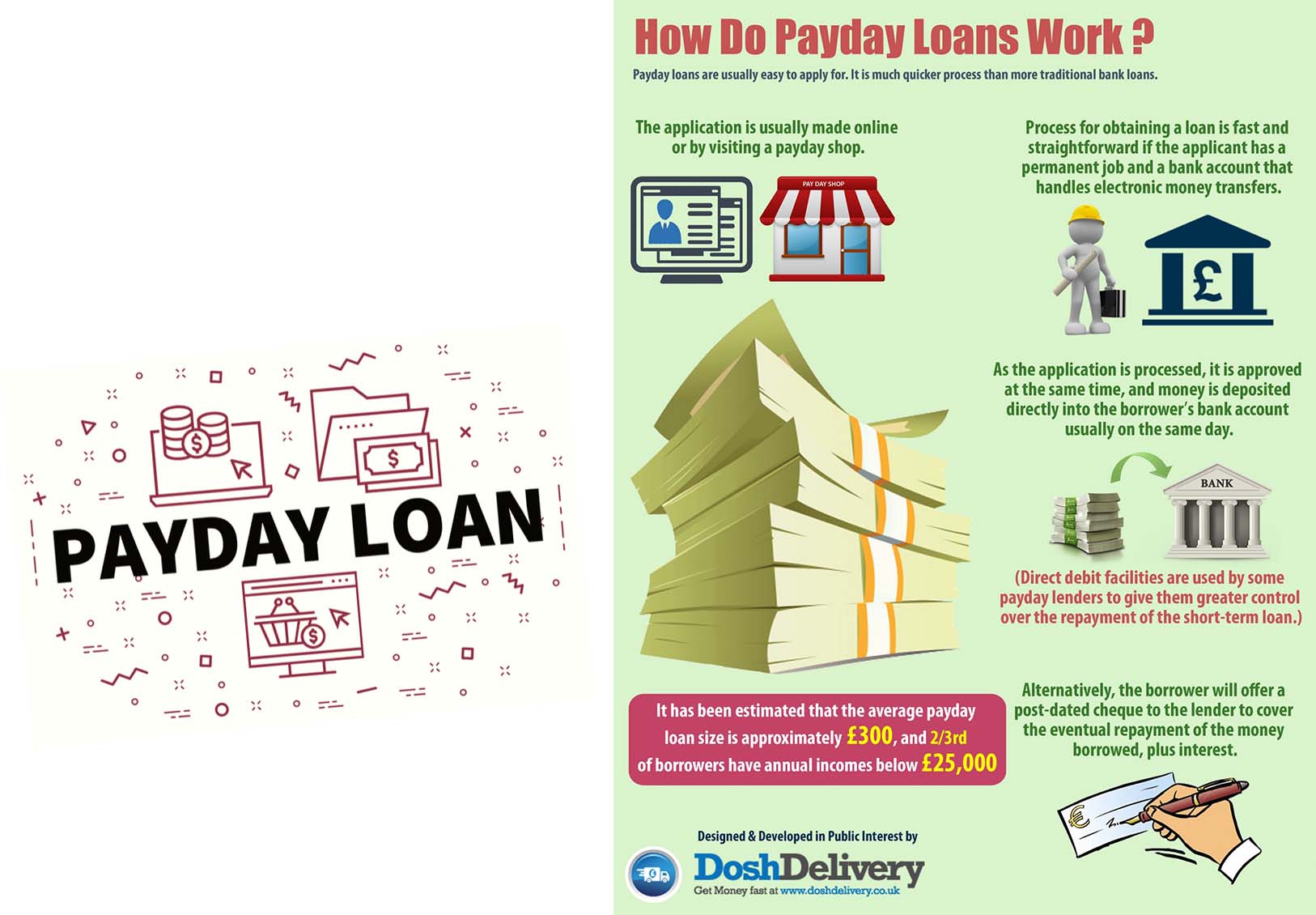

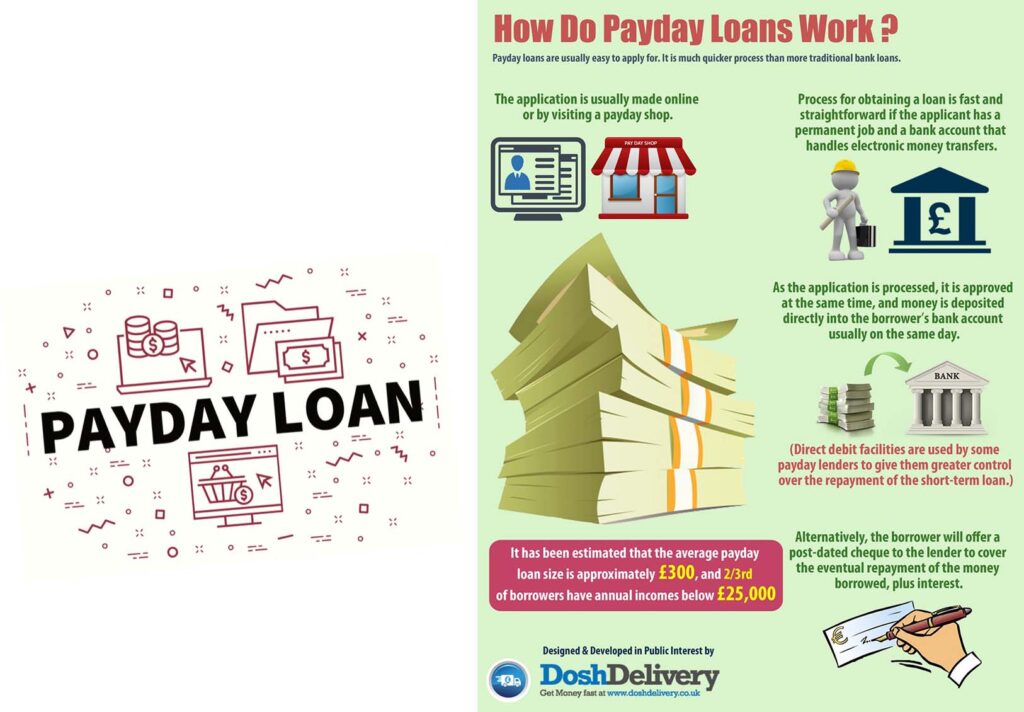

How Payday Loans Work

same day loans are meant to be a short-term solution. Borrowers write a postdated check or provide electronic access to their bank account for the loan amount plus fees. On the due date, usually aligned with the borrower’s next payday, the lender withdraws the funds. If the borrower is unable to repay the loan, they can roll it over, but this usually comes with additional fees and higher interest rates.

Benefits of Payday Loans

- Quick Access to Funds: Payday loans provide fast access to cash, making them ideal for emergencies.

- No Credit Check: Lenders usually don’t perform extensive credit checks, making these loans accessible to individuals with poor credit.

- Simplicity: The application process is straightforward, requiring minimal documentation.

Drawbacks of Payday Loans

- High Interest Rates: Payday loans often come with high APRs, making them expensive if not repaid promptly.

- Debt Cycle: Rollovers can lead to a cycle of debt, where borrowers continuously owe more due to accumulating fees.

- Predatory Lending: Some lenders use unfair practices, taking advantage of vulnerable borrowers.

Understanding Interest Rates

Interest rates for payday loans can be exceptionally high, often exceeding traditional loans. This is due to their short-term nature and the perceived risk for lenders. It’s crucial to understand the APR and fees associated with the loan to make informed decisions. $255 payday loans online same day

Short-Term Same Day Loans

Short-term loans, like same day loans, are designed to be repaid quickly. They offer convenience and can be helpful in urgent situations. However, borrowers should carefully consider the terms and costs involved.

Eligibility for Payday Loans

Eligibility requirements for payday loans vary by lender but generally include being of legal age, having a steady income, and a valid bank account. Lenders may also consider credit history.

Payday Loans Online Application Process

Applying for a payday online loan is simple. It typically involves filling out an application online or in-store and providing proof of income, identification, and a bank account. Approval can be quick, often within minutes.

Urgent Emergency Funds Loans no Credit Check

Pay day loans are often used as Urgent Emergency Funds Loans no Credit Check due to their quick availability. They can help cover unexpected expenses when other options are limited.

Payday Loan vs. Traditional Loans

Pay day com loans differ from traditional loans in terms of their requirements, application process, and repayment terms. Understanding these differences can help borrowers make informed choices.

Paydayloans Repayment and Renewal Options

Borrowers must repay payday loans on the due date. If they can’t, they may have the option to roll over the loan by paying additional fees. However, this can lead to a cycle of debt.

Common Myths About Same Day Loans

- Myth: Payday loans are a long-term solution.

- Myth: Only people with bad credit use payday loans.

- Myth: Payday lenders don’t care if borrowers can repay.

Urgent Same Day Loans for Bad Credit Loans

Payday loans can be appealing to individuals with bad credit because credit checks are often less stringent. However, borrowers should be cautious about the high costs.

Best Alternative Online Payday Loans

- Borrowing from Family and Friends: Consider seeking help from loved ones.

- Personal Installment Loans: These loans offer longer repayment terms and more reasonable interest rates.

- Emergency Assistance Programs: Some organizations offer financial aid to those in need.

How to Choose a Lender

When choosing a payday loan lender, consider factors like interest rates, fees, customer reviews, and the lender’s reputation. Compare options to find the best fit for your needs.

Tips for Responsible Borrowing

- Borrow Only What You Need: Avoid borrowing more than necessary.

- Read the Fine Print: Understand the terms and fees associated with the loan.

- Repay on Time: Timely repayment can prevent additional fees and debt accumulation.

Frequently Asked Questions

- Can payday loans help build credit? Payday loan are usually not reported to credit bureaus, so they typically don’t affect credit scores positively.

- What happens if I can’t repay the loan on time? If you can’t repay on time, you might have the option to roll over the loan, but this comes with added fees and can lead to a cycle of debt.

- Are payday loan available in all states? Payday loan regulations vary by state, so availability and terms differ.

- Can I have multiple pay day loans at once? Depending on your lender and state regulations, having multiple payday loans simultaneously might be possible.

- Are there alternatives for low-income individuals? Yes, there are alternatives like community assistance programs and nonprofit organizations that offer financial help.

- Do payday lenders check credit scores? Many payday lenders don’t perform traditional credit checks, making them accessible to individuals with poor credit.

- How quickly can I get the funds? If approved, you could receive the funds within hours or the next business day.

- What is the maximum loan amount I can get? Loan limits vary by lender and state, but payday loans are generally small-dollar loans.

- Can I repay the loan early? Yes, you can usually repay the loan early, but make sure to check with your lender about any prepayment penalties.

- Are there any alternatives to same day loans? Yes, alternatives include personal loans, credit cards, and emergency assistance programs.

Conclusion

In conclusion, pay day loans can be a viable option for individuals facing unexpected financial challenges. While they offer quick access to funds, it’s essential to carefully consider the costs, terms, and repayment options before committing. Responsible borrowing and exploring alternatives are crucial steps in making informed financial decisions.