Credit card rewards programs are an excellent way to make the most out of your spending habits. If you use your credit card wisely, you can earn various rewards such as cashback, travel miles, or gift cards. However, many cardholders are unsure of how to redeem these rewards effectively. In this comprehensive guide, we will walk you through the process of redeeming credit card rewards so that you can maximize the benefits of your credit card.

Understanding Credit Card Rewards

Before delving into the redemption process, it’s crucial to understand the types of rewards your credit card offers. Credit card rewards typically fall into three categories:

The Basics of Credit Card Rewards

Credit card rewards are incentives offered by credit card issuers to encourage cardholders to use their cards for everyday spending. These rewards come in various forms, including cashback, travel miles, points, and more. Cardholders earn these rewards based on their spending habits and the terms of their credit card agreements.

Types of Credit Card Rewards

Credit card rewards can vary significantly from one card to another. Common types of rewards include:

- Cashback: Cardholders receive a percentage of their spending back in cash or statement credits.

- Travel Miles: These rewards can be redeemed for flights, hotels, and other travel-related expenses.

- Points: Points can often be redeemed for a variety of rewards, including gift cards, merchandise, or even experiences.

- Rewards Tiers: Some cards offer different levels of rewards based on spending thresholds.

- Co-Branded Rewards: Certain credit cards partner with specific airlines, hotels, or retailers to offer specialized rewards.

The Value of Credit Card Rewards

Understanding the value of your credit card rewards is essential for maximizing their benefits. The value can vary depending on how you redeem them. For instance, a point earned from a travel rewards card might be worth more when used to book a first-class flight compared to redeeming it for gift cards.

By grasping the basics of credit card rewards, you can start your journey towards reaping the benefits of these programs.

Choosing the Right Credit Card

Researching Credit Card Options

When it comes to choosing the right credit card for maximizing your rewards, research is key. Start by exploring the various credit cards available in the market. Look for cards that align with your spending habits and financial goals.

Evaluating Rewards Programs

Not all credit card rewards programs are created equal. Some may offer higher rewards rates in specific spending categories, while others provide flat-rate rewards on all purchases. Evaluate these programs to determine which one suits you best.

Matching Your Spending Habits

To make the most of your chosen credit card, ensure that it complements your spending habits. If you frequently dine out, a card with bonus rewards for restaurant spending may be a good choice. Similarly, if you travel often, a travel rewards card with perks like airport lounge access and free checked bags might be ideal.

By matching your credit card to your spending habits, you can ensure that you earn rewards efficiently.

Accumulating Credit Card Rewards

Making Everyday Purchases

To accumulate credit card rewards, use your card for everyday purchases. This includes expenses such as groceries, gas, and utility bills. The more you use your card, the more rewards you can earn.

Maximizing Bonus Categories

Many credit cards offer bonus rewards in specific spending categories, such as dining, travel, or groceries. Take advantage of these bonus categories to earn rewards more quickly and efficiently. For example, if your credit card offers 3% cashback on dining, using it when dining out or ordering food can add up significantly over time.

Special Promotions and Offers

Credit card issuers frequently run special promotions and offers to encourage cardholders to spend more. Keep an eye out for these deals, as they can provide bonus rewards, discounts, or even cashback on specific purchases. These promotions can be a valuable way to boost your rewards balance.

Managing Your Credit Card Account

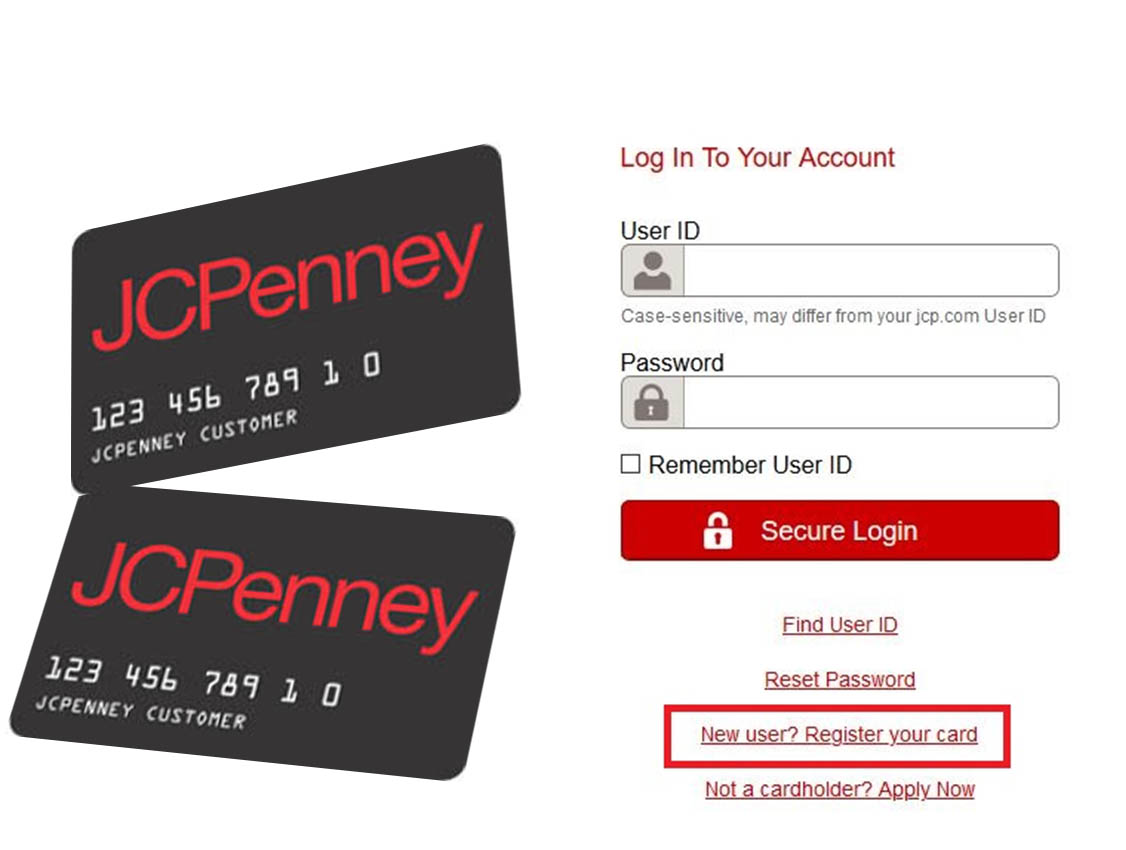

Monitoring Your Rewards Balance

It’s crucial to stay informed about your rewards balance. Most credit card issuers provide online account access, where you can track your rewards balance in real-time. This allows you to see how close you are to reaching your redemption goals.

Tracking Expiration Dates

Credit card rewards often come with expiration dates. If you don’t use your rewards within a specified time frame, you could lose them. Make sure to note these dates and plan your redemptions accordingly to avoid losing out on your hard-earned rewards.

Avoiding Late Payments

Late payments on your credit card can have a detrimental impact on your rewards strategy. Not only can they result in fees and interest charges, but they may also affect your credit score, making it harder to qualify for premium credit cards with better rewards.

By managing your credit card account responsibly, you can safeguard your rewards and maintain a healthy credit history.

Redemption Options

Cashback Rewards

Cashback rewards are among the most straightforward redemption options. They allow you to receive a portion of your spending back in cash or as a statement credit. This is an attractive option for those who prefer immediate, tangible rewards.

Travel Rewards

Travel rewards offer cardholders the opportunity to use their points or miles for various travel-related expenses. These can include flights, hotel stays, car rentals, and even vacation packages. Travel rewards are popular among frequent travelers looking to offset their travel expenses.

Gift Cards and Merchandise

Many credit card rewards programs allow you to redeem your points for gift cards or merchandise. While these options can be convenient, the value of your rewards may vary depending on what you choose. Be sure to compare the value of these redemptions to other options available.

Statement Credits

Statement credits can help reduce your credit card balance directly. For example, if you have accumulated $100 in cashback rewards, you can apply it as a statement credit, effectively reducing your outstanding balance by $100.

Charitable Donations

Some credit card issuers allow cardholders to donate their rewards to charitable organizations. This is a meaningful way to make a positive impact on causes you care about using your credit card rewards.

Redeeming Cashback Rewards

Requesting a Statement Credit

One of the simplest ways to redeem cashback rewards is by requesting a statement credit. This effectively reduces your credit card balance. To do this, log in to your credit card account online, navigate to the rewards section, and select the option to redeem your cashback as a statement credit.

Depositing into a Bank Account

Depending on your credit card issuer, you may have the option to deposit your cashback rewards directly into your bank account. This provides you with liquidity, allowing you to use the cash as you see fit.

Applying Towards Your Balance

Alternatively, you can apply your cashback rewards toward your current credit card balance. This reduces the amount you owe, and you’ll need to pay less when your statement is due. It’s a practical way to use your rewards to manage your credit card debt.

Redeeming Travel Rewards

Booking Flights and Hotels

Travel rewards can be incredibly valuable when booking flights and hotels. Many credit card issuers have travel portals where you can redeem your points or miles for travel expenses. In some cases, you may even find discounted rates or special promotions when booking through these portals.

Upgrading Your Travel Experience

For those looking to elevate their travel experience, consider using your travel rewards for upgrades. This can include upgrading your economy class flight to business or first class, booking a premium hotel suite, or gaining access to airport lounges for added comfort during layovers.

Transferring Points to Partners

Some credit card rewards programs allow you to transfer your points or miles to partner airlines or hotel chains. This can be a strategic way to maximize the value of your rewards, as partner programs often offer unique benefits and opportunities for redemption.

Getting the Most Value from Your Rewards

Points Valuation Strategies

Not all credit card rewards are created equal, and their value can vary widely depending on how you choose to redeem them. To get the most value from your rewards, it’s essential to understand the valuation of your points or miles. Research and compare redemption options to ensure you’re making the most financially sound choices.

Timing Your Redemptions

The timing of your redemptions can also impact the value you receive. Some credit card rewards programs offer limited-time promotions or increased redemption rates during specific periods. Staying informed about these opportunities can help you maximize your rewards.

Special Redemption Bonuses

Occasionally, credit card issuers offer special redemption bonuses. For example, they may provide a 10% bonus on cashback rewards when redeemed for travel during a specific period. Take advantage of these offers when they align with your redemption goals.

Avoiding Common Pitfalls

Unused Rewards

One common pitfall is letting your rewards go unused. To avoid this, regularly review your rewards balance and set reminders to redeem them before they expire. Unused rewards represent missed opportunities to maximize your credit card benefits.

Expiration and Forfeiture

Most credit card rewards programs have expiration dates or terms that can lead to the forfeiture of rewards. Be aware of these terms and plan your redemptions accordingly to avoid losing your hard-earned rewards.

Overspending for Rewards

While earning rewards is enticing, it’s crucial not to overspend in pursuit of rewards. Overspending can lead to credit card debt and negate the value of your rewards. Always prioritize responsible spending and budgeting.

Credit Score Impact

Positive Effects

Responsible use of credit cards, including earning and redeeming rewards, can have positive effects on your credit score. On-time payments, low credit utilization, and a long credit history are all factors that contribute positively to your credit score.

Potential Negative Effects

However, mismanaging credit cards can also have negative consequences. Late payments, high credit card balances, and excessive credit card applications can harm your credit score. It’s essential to balance your pursuit of rewards with responsible credit management.

Credit Card Reward Tax Implications

Taxable Rewards

In the eyes of the IRS, some credit card rewards may be considered taxable income. For example, if you receive cashback rewards or bonuses for opening a new credit card account, these may be subject to taxation. It’s important to be aware of the tax implications of your rewards and report them as required by law.

Reporting Requirements

To stay compliant with tax regulations, it’s essential to keep accurate records of your credit card rewards. If you receive taxable rewards, report them on your annual tax return as income. Failing to do so can result in penalties and interest from the IRS.

Protecting Your Personal Information

Security Best Practices

When engaging in credit card rewards programs, it’s vital to prioritize the security of your personal information. Follow these best practices to protect your data:

- Use strong, unique passwords for your online accounts.

- Enable two-factor authentication when available.

- Regularly monitor your credit card statements for unauthorized transactions.

- Be cautious about sharing personal information over the phone or via email.

Avoiding Phishing Scams

Phishing scams are a common tactic used by cybercriminals to steal personal information. Be cautious of unsolicited emails or phone calls that request sensitive information, such as your credit card number or Social Security number. Verify the legitimacy of the request before sharing any information.

Leveraging Loyalty Programs

Hotel and Airline Loyalty Programs

In addition to your credit card rewards, consider joining hotel and airline loyalty programs. These programs offer additional benefits, such as free nights at hotels, upgrades, and priority boarding, further enhancing your travel experience.

Retail Loyalty Programs

Many retailers offer their own loyalty programs, which can complement your credit card rewards. These programs often provide discounts, exclusive access to sales, and rewards for repeat purchases.

Credit Card Rewards for Small Businesses

Business Credit Cards

Small business owners can also benefit from credit card rewards. Business credit cards often come with rewards tailored to business expenses, such as office supplies, advertising, and travel. These rewards can help offset business costs and improve cash flow.

Employee Card Benefits

If you have employees, some business credit cards allow you to issue employee cards. These cards can help you earn rewards on your employees’ spending while setting individual spending limits and monitoring expenses.

Strategies for the Travel Enthusiast

Planning Dream Vacations

For travel enthusiasts, credit card rewards offer a unique opportunity to plan dream vacations without breaking the bank. By strategically earning and redeeming rewards, you can visit destinations you’ve always dreamed of.

Travel Hacking Techniques

Travel hacking involves using credit card rewards and loyalty programs to maximize travel benefits. This can include finding sweet spots in award charts, taking advantage of stopover rules, and booking open-jaw itineraries to explore multiple destinations in one trip.

Airport Lounge Access

Several premium credit cards offer airport lounge access as a perk. This can provide you with a comfortable and relaxing environment while waiting for your flight, complete with amenities like free food and drinks.

Advanced Reward Redemption Tactics

Combining Multiple Credit Cards

Some cardholders take their rewards strategy to the next level by combining multiple credit cards. By using cards with complementary benefits and rewards, you can optimize your earning potential and unlock more redemption options.

Utilizing Transfer Partners

Many credit card rewards programs have transfer partners, such as airlines and hotel chains. Transferring your points or miles to these partners can often yield higher redemption values and access to exclusive experiences.

Redeeming for Luxury Experiences

For those looking to indulge in luxury experiences, some credit cards offer exclusive opportunities, such as access to premium events, fine dining, and luxury hotels. Redeeming your rewards for these experiences can create memorable moments.

Reviewing Your Redemption Strategy

Regular Assessment

Your financial goals and spending habits may evolve over time. It’s essential to regularly assess your redemption strategy to ensure it aligns with your current objectives. Consider whether your credit card still suits your needs and if there are better options available.

Adjusting for Life Changes

Major life changes, such as buying a house, starting a family, or changing jobs, can impact your financial situation. Be prepared to adjust your rewards strategy to accommodate these changes and make the most of your credit cards.

Staying Informed About Card Changes

Keeping Up with Terms and Conditions

Credit card terms and conditions can change, affecting rewards programs, fees, and benefits. Stay informed about these changes by regularly reviewing communications from your credit card issuer and checking for updates online.

Evaluating Annual Fees

Many credit cards with robust rewards programs come with annual fees. Evaluate whether the benefits you receive from the card justify the cost of the fee. If not, consider downgrading to a no-annual-fee card or canceling the card altogether.

Legal and Regulatory Considerations

Consumer Protections

Credit cardholders benefit from various consumer protections under the law, such as the right to dispute charges and protection against unauthorized transactions. Familiarize yourself with these protections to ensure you can advocate for your rights as a cardholder.

CARD Act Compliance

The Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 introduced significant reforms to credit card practices. Ensure that your credit card issuer complies with these regulations, which include rules related to interest rate increases and fee disclosures.

Conclusion

The world of credit card rewards is a vast and dynamic one. By understanding the basics, choosing the right credit card, and managing your account wisely, you can unlock a world of opportunities and financial benefits. Whether you’re redeeming cashback for everyday purchases or planning a luxurious vacation with travel rewards, credit card rewards can enhance your financial journey.

In conclusion, remember that responsible credit card use is the foundation of a successful rewards strategy. By staying informed, making informed choices, and adapting to changes, you can make the most of your credit card rewards and enjoy a financially rewarding experience.